How To Find Product Market Fit

The term “Product-Market Fit” can be baffling for a lot of new Product Managers.

The phrase sounds great in theory, but in reality, finding product-market fit raises more questions than it answers:

- What is Product-Market fit?

- How do I know when I have Product-Market fit?

- How do I know when I don’t have Product-Market fit?

- More importantly, how do I find product-market fit for my product?

Hopefully, this post will be able to answer some of the questions for you.

What is Product-Market Fit?

According to Marc Andressen: “Product/market fit means being in a good market with a product that can satisfy that market.”

It’s a temporary state where your product is solving a big enough problem with the right solution for your customers.

When you find Product-Market Fit, you’ll see exponential organic growth driven by word of mouth.

The sales chart resembles a hockey stick, and customers are raving about your product.

Signs of Product-Market Fit

Here are four indicators I look at when assessing Product-Market fit:

- Exponential organic growth — if your product shows high levels of sales, conversion and user engagement, that’s a strong sign of Product-Market fit.

2. Very High User Retention — if your product is retaining at least 40% of the customers over a long period, you have a strong sign of Product-Market fit.

3. A three to one return on customer acquisition cost — if the cost to acquire the customer is 3 times less than the lifetime value then you have signs of Product-Market fit. (e.g. spending $1 to acquire a customer with a lifetime value of $3)

4. 40% of your customers will be “very disappointed” if your product is removed from the market. According to Sean Ellis if you survey your customer base and ask them:

“How would you feel if you could no longer use the product?’.

If 40% answers ‘very disappointed’, then you have signs of Product-Market fit.

Here are more areas you can look into but start with the four above.

When You Don’t Have Product-Market Fit

On the contrary, if the product is not showing any signs of traction mentioned above, it means you haven’t found Product-Market fit yet.

In addition, you’ll experience the following for your product:

- There are no clear buyer identity for your product

- You don’t have a clear customer journey

- Free users are not using your product

- Sales cycles are slow, or it’s not happening at all

- Customers are leaving you straight away after a trial

So How Do You Find Product Market Fit?

The secret to finding market-fit is about maximising the number of product iterations, with the limited resources you have. The deeper you know about your customers, the closer you are to finding Product-Market fit.

Here is a six-step process to help you find Product-Market fit for your product.

Step 1: Line up your product goals first

Step 2: Come up with product hypotheses

Step 3: Prioritise the product hypotheses

Step 4: Get feedback from five customers

Step 5: Make small bets with MVP’s

Step 6: Evaluate market traction

Now, put on your product goggles, we are diving deeper into each step.

Step #1 Line up Your Product Goals

To find Product-Market Fit (PMF)— you need to define what the PMF condition looks like. Is it exponential user signups? Or high revenue growth? Or is it having the largest market share?

The PMF goals need to align with your company's financial milestones. The CPO (or whoever the “Manager of Product Managers” is) will need to work with the CEO to agree on a strategy to achieve the financial milestones.

The financial milestones are broken down into Product Team Goals. The Product Team Goals will guide the Product Hypotheses that will be developed by the product team.

If you’re the only PM in your company, take the initiative to align your Product Team goals with your Product Leader. Ask for your team's goals for the current and next quarter. Skipping this step will cause a misalignment in company priorities.

Once the Product Team Goals are clear, it’s time to come up with Product Hypotheses.

Step #2 Coming up with Product Hypotheses

Product hypotheses are sometimes called product initiatives or product ideas. I prefer to call them hypotheses because I can detach my biases from the product idea.

To come up with product hypotheses, look at your internal and external data channels. Speak with customers, look at your product analytics, check out your competitors and speak with internal teams.

Generating product hypotheses is a blog on its own. Here is a blog from Hackernoon with a more in-depth explanation.

Once you have a few Product Hypotheses, centralise them in one place. Having ideas in one place allows for higher-level thinking. You can read more on how to centralise and manage ideas here.

Now that everything is in one place, it’s time to prioritise the most valuable hypotheses to make small bets with.

Step #3 Prioritising the Product Hypotheses

At this point, there will be a few assumptions and unknowns. That’s okay. You’ll validate the assumptions in Step #4 & 5.

Set up a prioritisation meeting with the core members of your product team — Tech Lead, a Designer, a Decision-Maker and a Subject Matter Expert. Keep the prioritisation meeting small. 4 to 5 team members is a good size.

Go through the list of Product Hypotheses and label each item with an expected Impact, Confidence and Effort.

- Impact means how likely you’ll be able to achieve your quarterly product goals

- Confidence means how much you understand the hypotheses and how risky the idea is

- Effort is an estimated effort based on a high-level tech solution

Once you’ve gone through the list of Product Hypotheses, you should see something like this:

Once you’ve decided on a few hypotheses to test, it’s time to speak with 5 customers to see what customers think.

Step #4 Get Feedback from Five Customers

Before you start building, seek feedback from five customers on the product hypotheses. Five customers should give you a good indication on whether if the idea is worth pursuing or not.

Use a mix of customer insights (qualitative data) and customer behaviours (quantitative data), so you can get a full picture of what people say vs what they do. Here is a guide on how to ask the right questions.

This process can take a few days to a few weeks. There are three scenarios you should expect:

- More than four customers are interested in the product hypothesis — this is the best-case scenario. Getting to 80% confidence is enough for you to move to the next step.

- Three out of five are interested — this is a tiebreaker and you might want to find more customers to speak with.

- Two out of five customers are interested in the product hypothesis — ask why and use the new insights to come up with new hypotheses. Add the new hypotheses into the backlog and reprioritise.

Assuming you’re getting good feedback from customers, it’s time to move onto the next step.

Step #5 Make Small Bets with Product Experiments

Product experiments are sometimes called “MVP’s” or “Prototypes”, or “Small Bets”. Regardless of the semantics, the purpose is to validate the hypotheses further by collecting proprietary data.

Proprietary data is the secret sauce to find Product-Market Fit. It generally includes the following insights:

- Your customer’s unique behaviour and the customer journey

- The pricing sensitivity of your target market

- Feature ideas for your next product iteration

- Insider knowledge about your product category

There are usually two types of experiments you can build:

- A Proof of Concept experiment that demonstrates the product but doesn’t fulfil the actual need of the customer. (e.g. smoke and mirror tests)

- A functional experiment that works, but it’s usually created with an unscalable solution or with minimal features. (e.g. “plain-donut” product)

You can also employ A/B tests to launch these experiments. The extend of your product experiment depends on the company risk and the resources you have.

You can read more about different experiments here and don’t forget to create a tracking plan for your product.

Step #6 — Evaluate Market Traction

Once you’ve launched your product experiment, keep a close eye for early signs of customer traction mentioned above. Stay close to the signs of traction below:

- Exponential organic growth in revenue, conversion, and engagement

- High user retention at a minimum of 40% of new customers

- At least a 3 to 1 return on customer acquisition cost over your customer lifecycle

- At least 40% of customers tell you they are “very disappointed” if the product is removed from the market

If the product is not showing any signs of traction, use tools like Fullstory or Amplitude to see why customers dropped off in your product. Use this as an opportunity to create new sets of insights and start the process again.

Finally — PMF is Not About Perfection, But Progress

Remember, chapter 1 starts when you launch. Product-Market fit is a prospecting process that takes multiple iterations.

In reality, nobody gets the product right in the first go. Twitter started an SMS service, LinkedIn was a job board, and GoPro was a film camera.

Once you’ve launched, follow these six-steps process to find Product-Market fit:

- Line up your product goals

- Come up with product hypotheses based on data

- Prioritise the product hypotheses

- Get feedback from five customers

- Make small bets with MVP’s

- Evaluate market traction

You want to maximise the number of iterations and focus on getting to know the customer. The deeper you know about your customers, the closer you are to finding Product-Market fit.

we’re going to look at one crucial question for businesses: what is product/market fit? Simply put, product/market fit is the ability of a product to satisfy the needs of a good market.

To help illustrate the product/market fit definition, let’s look at an example. Uber and Lyft can fit the needs of people who want an easily accessible method of transportation on demand. These are users who do not have the patience to call up a cab company and wait for them to find a driver in your area – these users also may not want human interaction.

Likely, Uber and Lyft considered product/market fit when developing their product. Knowing whether your product satisfies market needs is crucial for driving sales and building marketing campaigns that focus on the right features.

The failure of a product to understand consumers and the external factors that affect their decisions is a failure to find the right product/market fit. If there is no market for your product or if the market demand isn’t strong enough, it’s effectively dead in the water: no one will use it, and even worse, no one will pay for it.

As a startup, it’s crucial that you assess product/market fit; meaning you need to use market information to make a plan in order to achieve successful outcomes for your growing organization in the long term.

An example of missed product/market fit

Let’s look at an example of a company that didn’t quite understand the product/market definition or how crucial it is.

In August 2018, Hollywood producer Jeffrey Katzenberg and former CEO of HP Meg Whitman co-founded the company Quibi, a video platform meant exclusively for mobile viewing. Quibi was founded as an answer to the way younger generations were consuming more and more video content on mobile devices.

The company generated a huge buzz while attracting the talents of Steven Spielberg, Jennifer Lopez, and Liam Hemsworth and investments from Disney, Sony, and JPMorgan. The platform launched on iOS and Android in April 2020 with the goal of 7 million subscribers by the end of 2020.

However, in September the platform only had 500k subscribers. The following month, the platform announced that it would be shutting down, leaving the majority of its planned original content in development ruin.

Why did a platform with a promising business model miss the mark?

There are a couple of reasons why this is a perfect missed product/market fit example.

One reason is that Quibi began right when the COVID-19 pandemic was at its pinnacle: consumers were working from home or unemployed due to social distancing measures. If you have the option of watching content on your phone or your much larger TV, you likely opted for the latter. Hence, the target mindset of Quibi’s consumers became null and void.

Also, the target younger demographic for Quibi was used to watching content on free platforms like Instagram, YouTube, or TikTok. Most ad-supported mobile platforms are free to the user while the ad-supported subscription for Quibi costs $5 per month – a bit egregious by most users’ standards.

The problem with Quibi and numerous other products is a failure to establish a good product/market fit.

How to establish a good product/market fit

So, what is the product/market fit process? Before we delve into how to establish whether your product is a good fit in the market, it’s important to understand that structure is a key part of the process.

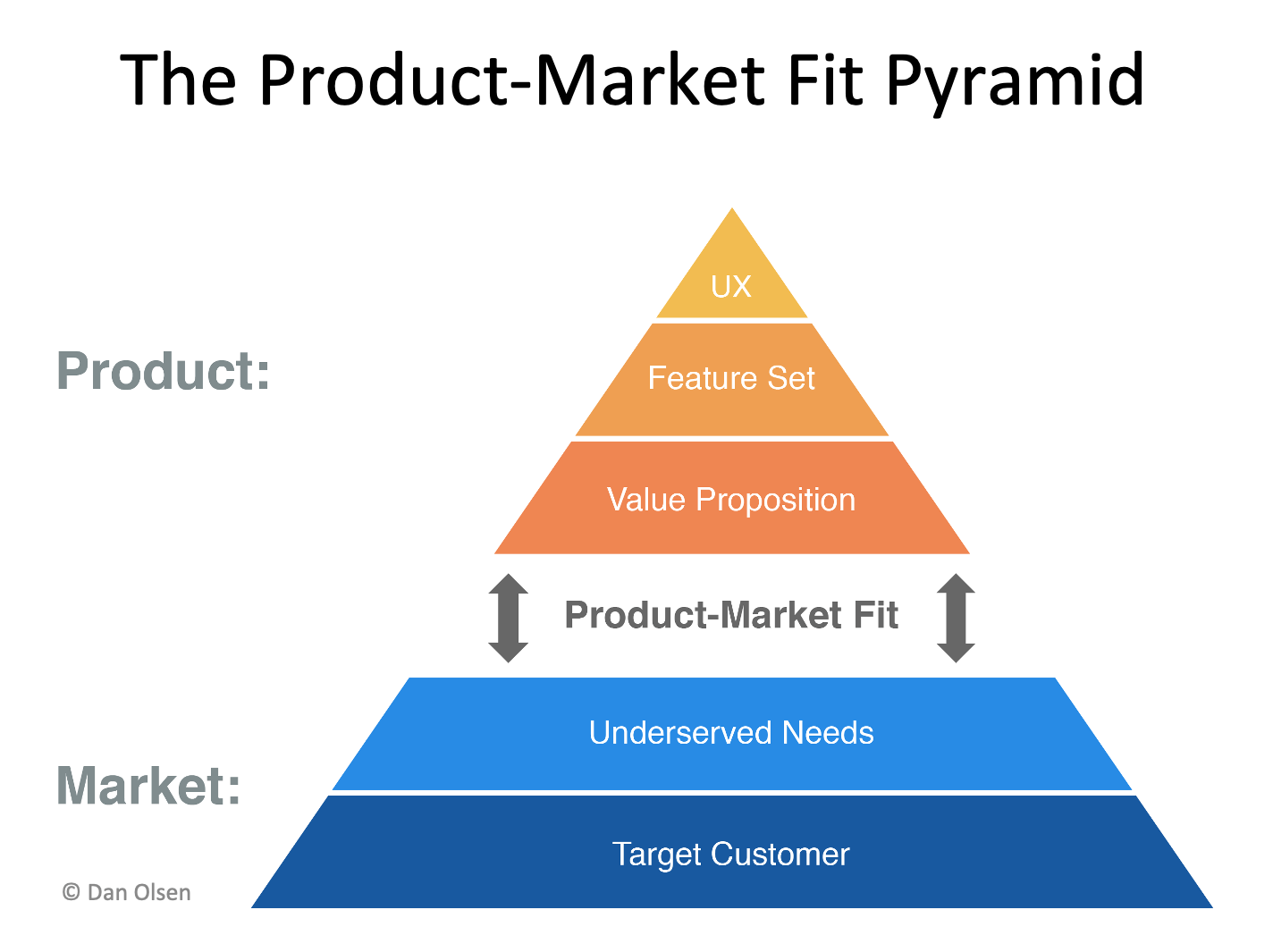

The concept is best articulated by Dan Olsen’s product/market fit pyramid as it shows both how and what pieces need to come together for a good product/market fit.

The market: Understanding all potential customers’ needs

Your target customer should serve as the base upon which all other concepts are built. After all, your consumer determines your product’s success.

It is the underserved needs, the next layer in the pyramid, that unite all your consumers in their interest in a product. While ages, demographics, and life situations may all be different for your target customer, their underserved needs are all shared.

For instance, you and your Dad are from different generations and possibly gender, but you both are interested in spending time with your family. Together, your target customers and underserved needs create your market.

The product: Satisfying that market

Now comes product development. Your value proposition should essentially be the answer to your customer’s needs. This value proposition should logically follow your feature set which should allow for the value proposition to be realized.

The UX, or user experience, should make implementing the features of the product a pleasant experience.

For example, Airpods’ value proposition could be something like “listen to music and make calls confidently on-the-go.” The feature set could be listening to music, making a call, or fitting into the contours of your ear securely. Now, what does a user need to do to make these features work? How would they describe the experience? This is the UX or the user experience.

Verifying a good product/market fit

Now that we know the answer to “what is product/market fit?”, how can we be sure a product is hitting the mark?

If the pyramid is a perfect representation of product/market fit, a poor representation would be one where each layer is precariously resting on the other. For example, maybe your product’s value proposition doesn’t totally speak to the needs of your audience even though your feature set does. Or worse – your features don’t live up to your value proposition.

Product/market fit is all about making sure each layer lines up with one another. Sometimes you can get a sense of product/market fit by doing your research and talking to your customers directly. With their feedback, you can know instantly if you have a poor product/market fit.

We’ll talk about the metrics which can be used to determine a successful/unsuccessful product/market fit a little later on.

How to measure product/market fit

When measuring product/market fit, you must consider three things: doing the research, understanding the market through metrics, and utilizing tools to measure Net Promoter Score and Product/Market Fit to evaluate and improve your product.

Step one: Research your target customers

Before going in-depth on the metrics that determine the success of your product, do your research. It’s important to have a clear understanding of what your target customers want by observing how they react to competing solutions in the market.

Articles, user behavior studies, industry groups, and social media are all great sources to tap for the reality of the market and what consumers want. Or, try searching for hashtags on Twitter to hone in on topics your target customers care about most.

The market information you find may reveal gaps between the layers of your product/market fit framework. Maybe you’ve found that your target customer doesn’t actually have the needs your product works to solve and your messaging could use some adjustments based on that. This research will quickly reveal where changes need to happen in your pyramid.

Next, consider talking directly to customers who use your product or would be the target customer for the product you want to develop. It might be best to include super-users – those who cannot live without your product – in the discussion.

Here are some items to consider for the conversation:

- Lead the discussion in a way that can expose misalignment in your pyramid’s layers if they exist.

- Ask your clients if they understand your value proposition (of course make sure that it is clearly defined).

- Ask them if they feel the product lives up to this value proposition and if not, what they would change for it to do so.

- Ask them how easy it is to use the product.

Finally, aggregate the feedback from a good amount of conversations to influence your future product roadmaps or help develop a new product.

Step two: Identify the size of the market you can actually hit with metrics and tracking

To assess product/market fit, you first need to understand the market you are addressing with actual metrics tied to revenue potential. Though your product may have a market, you need to validate that the market demand is strong enough to warrant investment:

- The first step of this product/market fit analysis is determining your Total Addressable Market (TAM) and identifying the size of the market you can actually hit. Your TAM should be the users who have the underserved needs you are looking to target. But your ability to hit those users is affected by the geography you service, which is your Service Addressable Market (SAM).

- Within your SAM is your Service Obtainable Market (SOM) – the number of users you can realistically acquire. There is no one way to get this number other than your own estimations and research, so think back-of-the-napkin product math.

- Then multiply your SOM number by your Average Revenue per User (ARPU) which will give you the total potential revenue for your business. Factor in costs to get your possible profit and use this number as your north star.

Now that you have your number for potential revenue, you need to assess how well you are hitting it and track this over time with the SaaS rule of 40. The SaaS rule of 40 is a general principle that states your growth rate and profit are inversely related and will usually add up to 40.

For example, if your growth rate is 35% year over year or month over month, your profit could be 5%. Makes sense, right? Now increase the cost to the consumer, your profit goes up and your growth rate goes down as prospects are deterred from the price point.

But what happens if your combined growth rate and profit are below 40%? It may be time to reassess your messaging or whether or not your target customer or their underserved needs are as pervasive as you had thought. If you are exceeding a sum of 40%, pat yourself on the back: your product makes a profit while continuing to grow. Of course, 40 isn’t the only number to use and it will vary depending on your product and the market it serves.

Step three: Measure product/market fit with NPS and PMF

If your combined growth and profit are smaller than 40%, it’s likely your product hasn’t found the fit. In this case, Net Promoter Score (NPS) can help confirm. Net Promoter Score can be attained by asking your users through the survey question: “How likely are you to recommend our product to a friend or colleague?”.

Users can select a number 0-10 where 0 is “not at all likely” and 10 is “highly likely.” Users most likely to recommend are Promoters (9-10). Users who are apathetic about your product and are vulnerable to competing products are Passives (7-8). Those who are not happy at all operate in the widest range as Detractors (0-6).

The larger your group of participants, the more confidence you can have that the % of each group represents your SAM. Now subtract your % of Detractors from your percentage of Promoters. The result is your NPS.

As your NPS can range from -100 to 100, you should want your NPS to be somewhere in the positive range to show you have more Promoters than Detractors. If you’re not at least in the positives, your product needs some work. If your product is anywhere in 0 – 50, there may be a few things worth tweaking that could bring your NPS up a few points.

You can also find your product/market fit directly with Product/Market Fit (PMF) surveys. Also known as the “Sean Ellis test,” PMF surveys ask users a simple question: “How would you feel if you could no longer use [product]?”

Unlike the NPS survey’s numbered scale, the initial PMF survey question uses a 3-point negative scale (Not disappointed, Mildly disappointed, and Very disappointed). If 40% of users answer “Very disappointed,” you’ve successfully achieved product/market fit. And the more people who answer “Very disappointed,” the stickier your product is, and the closer you are to meeting the needs of the market.

You can use the Delighted survey platform to evaluate your own NPS and PMF scores and include other questions that might reveal more details about why your product isn’t achieving product/market fit.

Like all aspects of product development, product/market fit is an iterative process.

When figuring out what is a product/market fit in your situation, it’s crucial to do your research, create your hypotheses, build it, test it, and feed your findings back into the process. No company nails product fit with the market right away, but with proper planning and intentional research, you can get pretty close and see success that exceeds the 40% rule of SaaS and achieves a stellar NPS and PMF.

0 Comments